The global tech industry is closely watching as U.S.-China tech tensions escalate. Recent developments have introduced stricter export controls on advanced semiconductor technologies. These measures, announced by the U.S. Department of Commerce, aim to curb China’s access to critical technologies for artificial intelligence (AI) and chip manufacturing. The ripple effects could reshape global supply chains, market strategies, and industry dynamics.

What Are the New Export Controls?

The U.S. government has restricted the export of high-bandwidth memory chips and advanced semiconductor manufacturing equipment to China. These technologies are essential for building AI systems and producing next-generation chips. Companies like NVIDIA and AMD, known for their cutting-edge GPU designs, are directly affected by these regulations (Reuters).

In addition, the Commerce Department introduced measures targeting China’s ability to procure lithography tools. These tools are critical for advanced chip fabrication. By limiting access to this equipment, the U.S. aims to stall China’s progress in developing indigenous semiconductor capabilities.

Why Are These Restrictions Significant Regarding Semiconductors?

Semiconductors are the backbone of modern technology. They power everything from smartphones to data centers. Advanced chips are particularly critical for AI development, defense systems, and quantum computing. By controlling access to these technologies, the U.S. seeks to maintain its edge in global tech leadership.

However, these restrictions are not just about technology. They are part of a broader strategy to counter China’s rise as a tech superpower. The Chinese government has made significant investments in becoming self-reliant in semiconductors. These U.S. policies directly challenge that ambition (The Verge).

Global Impacts on the Semiconductor Industry

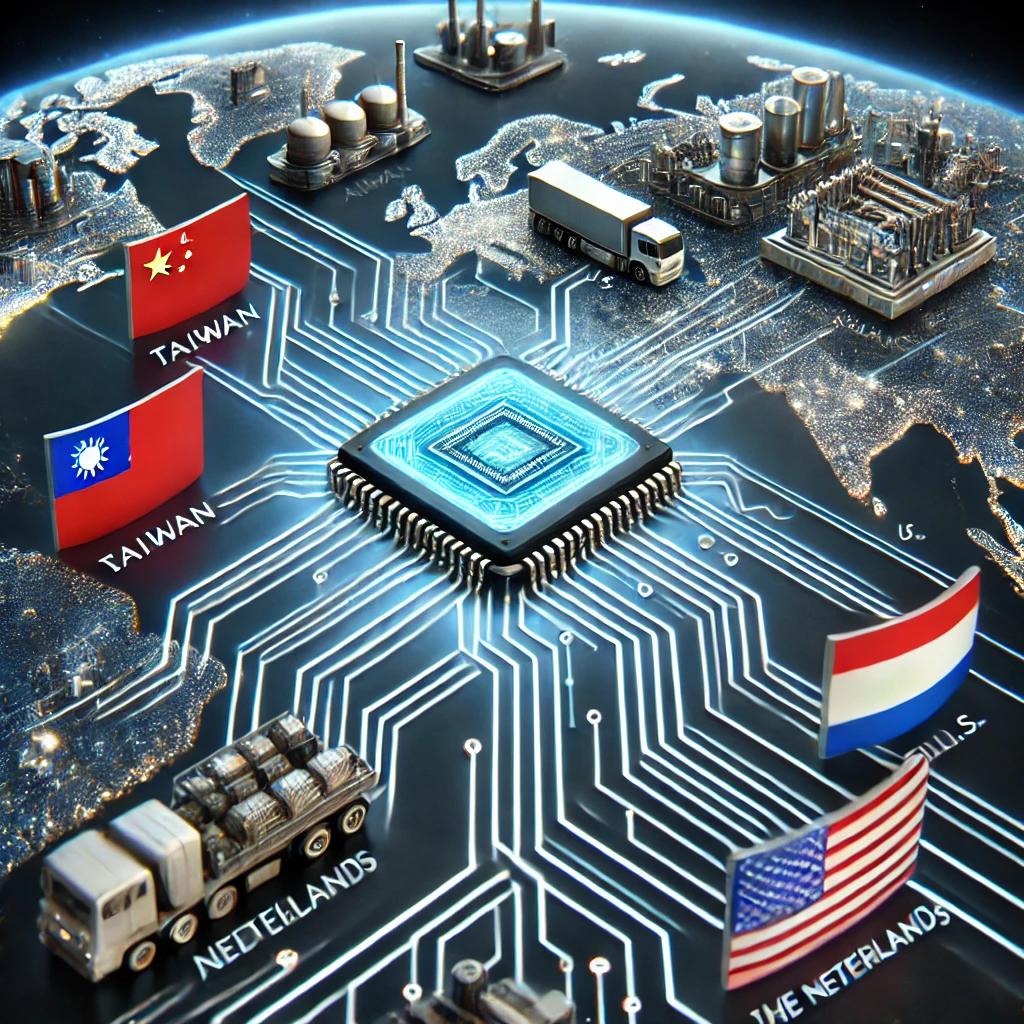

The semiconductor industry relies on a globally interconnected supply chain. Companies in Taiwan, South Korea, and the Netherlands play key roles in producing advanced chips. U.S. restrictions disrupt this balance. For instance, Dutch company ASML, which manufactures lithography machines, must navigate compliance with these new rules (ASML).

China is the largest consumer of semiconductors, importing over $300 billion worth annually. The new rules could reduce demand for equipment and chips from Western companies. At the same time, these measures might accelerate China’s efforts to create domestic alternatives.

Potential Risks for the Global Economy

Tech companies worldwide face increased uncertainty. Reduced access to the Chinese market could hurt revenue for U.S. firms like Intel and Qualcomm. Additionally, global supply chains may experience delays as manufacturers adapt to the new rules. Smaller companies relying on Chinese suppliers may also struggle to meet production goals.

On the flip side, these tensions might trigger innovation. By investing in research and development, companies could create alternative technologies. However, this shift will take time, leaving a potential gap in the market.

The Broader Implications

The U.S.-China tech rivalry is intensifying. This latest round of export restrictions highlights how geopolitical concerns are reshaping the tech landscape. For businesses, governments, and consumers, the stakes are high. Companies must navigate new compliance risks, while governments must balance security with economic stability.

Consumers may feel these changes through higher prices and slower innovation. With fewer players in the market, competition could decline, reducing incentives for technological breakthroughs.

Conclusion

The new U.S. semiconductor export restrictions mark a significant moment in the global tech industry. While aimed at curbing China’s technological rise, these measures have far-reaching consequences. They challenge businesses to adapt and innovate while raising questions about the future of global tech collaboration.

For those in the tech sector, staying informed is crucial. Understanding these dynamics will help navigate the challenges ahead. The full impact of these policies will unfold over time, but their importance is undeniable.